By Charles Curran, Principal and Market Data Analyst at Maskells.

Landlords playing a high-risk game that will undoubtedly leave casualties

In this paper we look at the upcoming Tax and Regulatory changes which will affect the leveraged Buy to Let Market in London and conclude that these are serious enough to trigger a sell-off. There is a desperate need for housing and a sentiment that Buy to Let Landlords have pushed house prices up as they were not constrained by the Mortgage Market Review regulations. In tinkering with the BTL Market, regulatory authorities are likely to create forced sellers from leverage landlords, creating more supply to the housing market and, dependant on the volume of that supply, pushing prices down. This may be good over the long-term for housing needs however in the short to medium term, many tenants in rented accommodation may be forced out and, with the natural reduction in rental stock, be subject to increased rents as they seek alternative accommodation.

The current market

The National Landlords Association maintains that there are over 860,000 private rental sector properties in the capital representing more than 1 in 4 households (6 May 2016) In the run up to the increase in Stamp Duty on BTL and Second Homes, the BTL Landlords took advantage of cheap debt helping to push overall lending up by 59% year on year and 43% more than in February according to the Council of Mortgage Lenders. The CML provide data on new Buy to Let Mortgages which show total advances for BTL house purchases at £7.1bn for March 2016 up 162% from the March 2015 (£2.7bn) representing 28,700 loans vs 8,800 in the same period a year earlier (Source CML). There are, as at March 2016, 1,839,800 outstanding BTL mortgages representing £222,800,000,000 in loan balances (Source CML, MM17M). This is expected to grow further: the Prudential Regulation Authority in their Draft Supervisory Statement on Buy to Let Underwriting Standards, maintain that “Firms plan to grow their gross buy-to-let lending by, on average, almost 20% per annum over the next two years”.

From 2000, the BLT market became a natural home for individual investors as it did not require an expert knowledge of the Stock Market or other financial instruments and high Loan to Value mortgages were readily available allowing Landlords to buy with very little cash down payment. A slow-down in 2009 and 2010 (largely due to a lack of bank financing) was reversed in 2011 and since then the total GBP outstanding balance of BTL mortgages has increased by over 41% (Source CML). BTL investors in London have also enjoyed considerable capital uplift, as have most of London’s property owners. Land Registry figures show a 61% increase in the average property price in the Capital from March 2010 to March 2016.

Notwithstanding the Sector’s popularity, the BTL mortgage is typified by short term fixed periods and interest only repayments, and have always been very susceptible to short term interest rate movements. In mid- 2015, the Bank of England noted:

“The actions of buy-to-let investors affect the broader housing and mortgage markets as individuals compete to buy the same pool of properties. Looser lending standards in the buy-to-let sector could contribute to general house price increases and a broader increase in household indebtedness. And in a downswing, investors selling buy-to-let properties into an illiquid market could amplify falls in house prices, potentially raising losses given default for all mortgages. This could be a particular concern in a rising interest rate environment, if properties become unprofitable given higher debt-servicing costs. Buy-to-let borrowers are potentially more vulnerable to rising interest rates because loans are more likely to be interest only and extended on floating-rate terms, and affordability tends to be tested at lower stressed interest rates than owner-occupied lending”

Financial Stability Report, Issue 37, July 2015 – Part A, UK Housing Market.

The Bank’s very clear stance on the BTL market has been enhanced by regulatory and political winds which have continued to push against the sector through 2016.

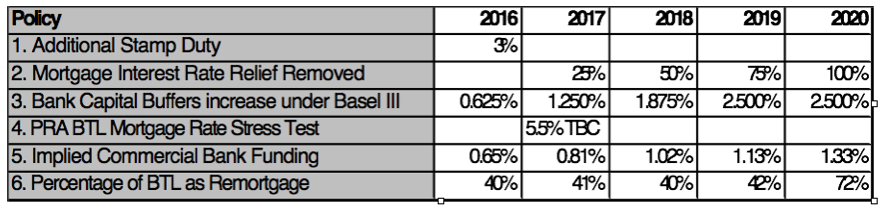

The two main concerns the BOE has are based on the nature of the BTL mortgage market and the effect of the BTL investor on house prices and both of these are now being addressed. The timing of these changes is as important as the changes themselves which are detailed below:

Sources per the points below:

1. Additional Stamp Duty

This rise has been well documented and needs no further comment, other than the seasonally adjusted number of residential property transactions increased by 41.5% between February and March 2016 (74.8% non-adjusted) and 69.7% higher in March 16 than March 15 (77.1% un-adjusted) (source HMRC – UK Property Transactions Count – March 2016). This confirms the analysis in the press that Buy to Let investors in particular were seeking to close transactions prior to the SDLT increase. A slowdown is now expected and we expect the Year on Year decrease in transaction volumes to be significant in March 2017.

2. Mortgage Interest Rate Relief

The removal of this deduction will certainly be one of the largest factors in determining whether a Buy to Let Landlords decides to exit the market. Certainly the higher value properties owned by Landlords who pay the Higher or Additional Rate of Income tax may well see an initial small reduction in their income if they hold a mortgage but they will become more pronounced over time as the reduction of the Relief becomes greater – and that is assuming that mortgage rates and underwriting criteria remain constant – which they will not. There have been many examples in the of Landlords reaching negative cash flow on their BTL property and this has been well reported.

3. Bank Capital Buffers

The cost of buy to let Mortgages for Banks will increase in the future which will push the cost of BTL mortgages up even without a raise in base interest rates. Under the current Basell III consultation, the standardised risk weighting for Buy to Let Mortgages could increase from 35% to 91% and even up to 120% for loans at 80% loan to value or higher. A £100,000 mortgage currently requires a £2,800 capital buffer (or reserve) - being 8% of the risk weighting - but may require £7,280 or even £9,600 if above 80% LTV. If a bank is required to set aside 2.6 times ( or 3.4 times for 80+ LTV loans) as much cash per loan, it may either raise BTL rates to take into account the loss of earnings on the reserved cash or it may just choose to exit the market, notwithstanding no potential move in base rates. (Source info: Fitch, calculations Maskells).

4. Prudential Regulatory Authority Consultation on Buy to Let Sector

The PRA’s consultation paper which is currently being reviewed calls for a minimum 5.5% interest rate stress test on ALL Buy to Let Mortgages regardless if the Lender does not think rates which reach this level during the life of the mortgage (usually 2 year fixed). The PRA would like to see Landlords own income to be taken into account when assessing the viability of a mortgage rather than just looking at the minimum rental cover of usually 125% of the rent received. By way of example, currently a 2.34% 2 year fixed BTL mortgage may be granted to a landlord receiving 4% annual yield but would not be granted under the PRA’s proposed consultation, without additional support from personal income analysis. Given that the Greater London rental yield is below 5% (and as low as 1.8% for parts of prime central London) it is unlikely that many Landlords will be able to reach this high bar. The consultation suggests that this rule should not be applied for re-mortgages but as this locks a landlords to one lender and makes interest rate shopping at the expiry of the fixed term of the mortgage almost impossible. The SVR at the end of the fixed term can be over 4.5% per annum.

Whilst many Landlords may decide to use their personal income to supplement the rental income in order to qualify under the PRA’s terms under consultation, they will find that they will be subject to a more stringent underwriting criteria than before.

5. Implied Commercial Bank Funding

Whilst BTL Mortgages may be very cheap, so is money in the financial markets. However with the demise of the majority of the private label securitisation market where term funding was available, most banks now only seek to lock in liabilities for 2 years hence only offering 2 year fixed rate product which then revert to floating rate. A quick search of the net will produce BTL offers of 2.18% Fixed for 2 years which then convert to SVR at over 4.5%, prompting BLT landlords to re-mortgage. The Bank of England’s UK commercial Bank Liability Curve suggests a 2 year funding curve per our table but culminating in 1.33% in 2020 (all things being equal as at 23/5/16) based on Libor, yields on Libor linked instruments, short sterling futures, forward rate agreements and Libor based interest rate swaps (source: Bank of England). However unlikely (as funding rates have not really risen) If bank rates do reach anywhere near 1.33% in 2020 from 0.65% today, bank funding will be unable to provide a fixed 2 year rate of 2.18% thereby implying a significant uptick in BLT mortgage interest rates up to 2020. By way of demonstrating this, a bank today may charge 1.52% for a BTL mortgage (being 2.18% less presumptive funding at 0.65%) however, if funding increases to 1.33%, and the bank seeks to maintain its profit margin, the mortgage would have to achieve 2.86%, more than 100% more than today. This is a simplistic calculation and there are many variables but we can be sure that Banks will not absorb unnecessary costs if they can be passed on to the mortgagee, particularly if the sentiment is to de-lever the BTL market.

6. Percentage of Buy to Let Market as Re-Mortgage

With the predominance of BTL Landlords seeking the cheapest possible funding to maximise their investment returns, most turn to an interest only two year fixed mortgage (with reverts to SVR at the end of 2 years). This provides a two year reset for 100% of the mortgages written in those 12 months. Looking at Buy to Let annual advances (source: CML) and taking into our view that BTL new issuance may well fall post 2018, we do expect an increase in the re-mortgage market vs the new BTL market. This may mean that Landlords may be beholden to one particular lender (see 4 above) but if that Lender is a bank seeking to reduce their exposure, and Landlords do not qualify for other mortgage products, given reasons we have examined above, we may find ourselves with forced sellers by 2020 and certainly sellers prior to this.

To recap the above points before we look at their effect on the Market. The BTL Landlord with a mortgage should reasonably expect the cost of the mortgage to increase substantially over the next four years. At the same time, the minimum 5.5% interest rate stress test proposed by the PRA will force existing mortgage holders to remain with the same lender and if they do choose to move, the rate and the LTV requirement (based on the PRA interest rate stress test) may well make it more challenging to refinance, leading to some landlords becoming forced sellers.

Prior to the Budget in 2015, the National Landlords Association (NLA) polled a sample of their London Landlords to determine their likelihood of selling – 4% maintained that they would consider selling. Jump forward to 2016 and as of January this number was now 19% (source NLA). The question is now to consider when this selling might occur.

Sell off in 2018/19?

Our analysis of the data used to populate the table on the prior page suggests that we might see BTL property coming to the sales market between April 2018 and April 2019. This is when the first and second tranches of the removal of interest rate relief come into effect which will be combined with an increase in capital charges for banks under Basel III which will push mortgage rates up.

Buy to Let mortgages usually have a fixed rate of payment for 2 years and then if not refinanced convert to a tracker mortgage: As of the 8th June 2016 and following the Court of Appeals ruling in favour of buy to let landlord clients of West Bromwich Building Society, we do expect the terms of Buy to Let Mortgages to now change. The issue being adjudicated was not that the Society sought to raise rates as a response to additional capital requirements required by the Bank of England, rather it was that the terms of the mortgage did not specifically allow it and that the reason given to raise the rate, which was “to reflect market conditions”, was not the catch all the Society had hoped for. We are almost certain that these terms are now being reviewed by West Bromwich and other lenders and additional language will be included in new mortgage loans given the requirements of Basel III. The increase that West Bromwich tried to pass to mortgage holders is evidence that banks will attempt to pass on any additional costs they incur, adding to the pressures faced by Landlords.

Conclusion

We are always sceptical of government intervention in a market: The tinkering in the BTL market, which has provided so much of the rental stock the country depends on, will lead to a sell-off. It will just not be economically viable for many Landlords to continue to provide rental accommodation and if they want to, they may find themselves trapped by not being able to re-new their financing. This is GREAT news for the government as there will be more properties on the market (bearing in mind that if the 19% of the Landlords in the NLA poll do sell that, will be an additional 163,000 homes on the market – more than the total of all new-builds in the UK last year) which will depress prices. For those who can weather the storm, the upside is that with smaller rental stock, we expect rents to jump dramatically in 2018-2019 as buyers still struggle to find deposits and compete with an expanding population for housing.

This situation does seem to us akin to a slow motion train crash: BTL Landlords with Mortgages are standing on the track in a game of chicken with regulatory locomotive, hoping to time their exit as best as possible. This high-risk game will almost undoubtedly leave casualties.