In 1726 Daniel Defoe wrote, in the Political History of the Devil, “Things as certain as death and taxes, can be more firmly believed”. At this time, England was subject to the Window Tax (1696-1851). The larger the house, the more windows it had and consequently the more tax was paid. As a counter to the tax, windows were bricked up leading to darkness in many homes. The Sales market in July and August certainly felt as if a wave of darkness had fallen over Prime Central and Prime London but we are happy to report that September has brought a new level of enquiry and more properties to the market (we are launching 16 new instructions this month). SDLT remains however a key concern, and more so than BREXIT.

Property Tax is nothing new, however a lack of certainty in property taxation as well as the current very high transaction costs had dampened demand. These changes include not only the ever-increasing rates of stamp duty but also the removal of mortgage interest rate relief (replaced by a lower threshold tax credit) for Buy to Let Landlords, additional duty for non- naturalised buyers and the proposed list of approved companies who can buy properties in the UK (a mechanism to reduce money laundering in the property market) . The weakness of Sterling has done little over the summer to encourage foreign buyers to head to the UK, even if property is in real terms is over 10% cheaper for them than prior to the Brexit vote.

The Treasury has been quite vocal about the extra stamp duty that it has collected YTD in justification for the increased tax – and lets face it with our twin deficits and public sector net debt, UK Plc needs the money – but tax changes forced buying (in this case buy to let investors in March 2016) which produced extra-ordinary SDLT income, masking the fact that both transaction volumes and SDLT receipts are down. Our analysis of the trading volumes provided by both Land Registry and HMRC follows:

Data from Land Registry suggests that property transaction volumes in England & Wales have risen by 18.39% from 2012 to 2013, 16.02% from 2013 to 2014 but fell by 0.80% from 2014 to 2015. Of note, in 2015 there was a decrease in transactions below £200,000 (most likely as a result of prices going up pushing more properties into tax liable SDLT bands) but from £200,000 to £1.25m the volumes increased an average of 14%. Above £1.25m, there was an average decrease in volumes of 15.64%, most notably from £1.75m upwards. If we strip out the extra-ordinary volumes (70,000+) due the BTL investors transacting in March, our projection for 2016 (of which the trading volumes for the 1st two quarters are known) is a decrease of 9.00% year on year) across all price ranges, except a modest increase of 4% in the £800,000 to £1.25m range.

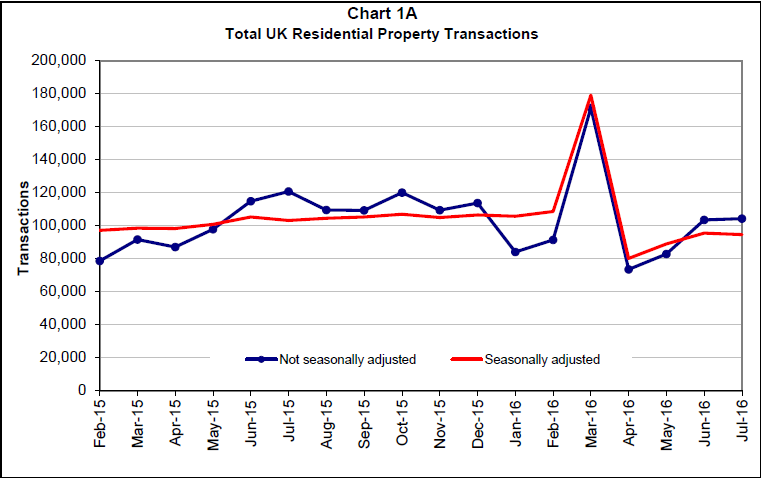

However what the Exchequer in interested in, is the number of SDLT liable transactions as this is where the tax is generated. In the Quarterly SDLT receipts from HMRC (July 29 2016) we can see that whilst SDLT receipts for residential properties rose by 27% in both 2012-13 and 2013-14, they fell by 6.95% from 2014-2015. We anticipate that SDLT receipts for 2015- 16 will be at a record high as a result of the rush of transactions in March 2016 but with those additional transactions stripped out, we would expect SDLT receipts to be flat year on year even with the reduction of sales volumes we anticipate. Property prices are increasing in the England and Wales (other than in London and parts of the South East). So it is logical to expect an increase in the value of each transaction and a corresponding increase in SDLT receipts. To give you a sense of the effect of the transaction volumes in March 2016, we have attached overleaf a chart from HMRC UK Property Transaction Statistics, August 23rd 2016. You will quickly see why SDLT receipts will look so healthy for 2016!

Source: HMRC UK Property Transaction Statistics 23 August 2016

The new SDLT has provided for a fundamental shift in the way property has been taxed. By taking property below £125,000 out of SDLT and abolishing the slab tax (which created dead trading zones around each new tax band and had the effect of slowing down transaction volumes and pricing), the new system whilst hailed as fair, actually promotes price increases and transaction volumes in lower value properties which over time will take more of these properties into Stamp Duty and the reach of the Exchequer. With a limited increase in housing stock, and now mortgage companies slowly eyeing increasing their rates (Halifax increased their tracker rate by 0.25% when base rates were cut by 0.25%, due to costs) it is inevitable that we see further house price increases as demand remains and housing stock available for sale decreases.

So what is the answer? Firstly build more homes (I know – easier said than done) and secondly reduce SDLT. 12% has crippled the South East, has prevented inward investment (even with a cheaper pound) and is damaging associated businesses such as conveyancing, surveyors, builders, and Estate Agents. Whilst this commentary might appear self-serving, foreign investment is essential to UK Plc and this is a road block to our economic growth. If no changes are made, then many buyers may well opt for a Robinson Crusoe experience rather than buy in the UK, and we as a country need that inward investment.

We waited a week before issuing the commentary to capture buyer sentiment in September. So far we have seen a marked increased in viewing demand with the team conducting 24 viewings yesterday alone. The test is going to be the conversion from viewings to offers once applicants have done the SDLT calculation and we look forward to updating you about this in a few weeks.

DOWNLOAD FULL REPORT (pdf)