By Charles Curran, Principal at Maskells

Whilst asking prices have remained high – aspirational even – prices at which properties have transacted recently are between 4-12% lower than asking prices (depending on area and property).

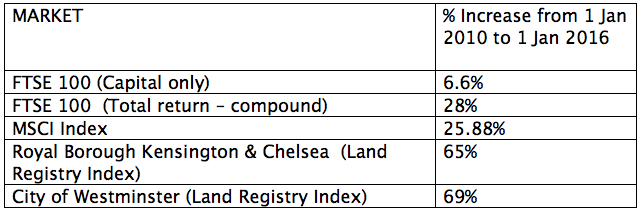

As estate agents, we understand the aspirations of a vendor and as an industry we are here to get the most money for our client’s asset. Launching a property at a realistic price is the right thing to do even if it appears high to those not in the industry– we need to see if there are buyers willing to come forward. The sensible course to follow, if no buyer is found, is to reduce the price. Price reductions in Prime Central London?? Yes. The property market has had a tremendous run over the past 5 years as evidenced by the table below:

Source: Yahoo Finance, FTSE.com, Bloomberg, Land Registry.

However markets have recently dropped and the 5 ytd return is now (-0.33%) for the FTSE 100.

But as with any market, there are ups and downs. Vendors need to ask themselves where the buyers are getting their cash – if the markets are down, City Bonuses are down, Sterling is expensive against the Euro, Oil is trading down, and the increased SDLT for second homes (including foreign property owners acquiring their first home in the UK) - sp will buyers naturally pay more this year than last for a home in Prime Central London? No, unless the property is a one of a kind which attracts multiple bids. If achieved prices in the Prime Central Market have fallen by 4-12% (area and property specific) then as a vendor your return over 5 years is still better than almost any fund manager in the city (Don’t rub his or her nose in it as they view your property!).

We are beginning to see Vendors take this into account and have aspirational prices being reduced to tradeable (but not cheap) levels. Buyers in this market should now take the opportunity to start looking again as the détente could now mean you are much closer to a deal than you might think possible.”